There are basically two groups of investors in their opinion of China's economy. In one camp are those who are optimistic on the economy’s strength and its ability to thrive in an otherwise bleak global environment.

The most recent economic data release showed a sharp rebound in the Chinese export sector has further enhanced the positive sentiment

In the other camp are an increasing number who believe that China’s economic

miracle is nothing but a mirage and that 2010 will be a year of painful reckoning. Some analysts are claiming that China’s growth model is fundamentally flawed and the massive stimulus measures adopted since late 2008 have only intensified the economy’s structural imbalances, which will make the inevitable downside adjustment even bigger. The usual worrying features of the economy such as asset bubbles, “mis-investment”, an inefficient banking system, growing social unrest and corrupt governance - some are predicting an imminent economic crash and even social chaos. Some prominent hedge fund managers have reportedly even begun shorting the “China story” in recent months. Well, for every buyer, there has to be a seller... so the story goes.

Is the economy headed toward a sudden collapse, as expected by the “house of cards” camp? The answers to these questions obviously weigh heavy in investors’ decision making. There has never been a lack of skepticism toward the Chinese economy. Even 5, 10, 15 years back, there were the usual China-bashers and permanent-bears who have been proven wrong over and over again by the country’s enormous economic success and social progress over the past three decades. However, the question marks about the country’s fundamental growth model deserve careful assessment. The core argument of this bearish camp is that the Chinese economy is mainly driven by capital spending and exports, both of which have exhausted their potential. The economy is bound to slow sharply due to a lack of new sources of growth. Or is that the full picture?

While there is always a chance of a major collapse in any economy, I think China is going to chug along just fine. I do not think that China’s capital spending is excessive. China’s capital spending boom has mainly been driven by profit incentives rather than government direction. Those who think that China’s capital spending is terribly inefficient and will face an imminent crash will be proven wrong. If you take the data and extrapolate on internal capital returns on the country's projects - China's figure is very much in line with other developing countries.

Second, one may argue that the U.S. consumer sector has entered into a prolonged period of deleveraging, and that its demand for Chinese products will never recover to pre-crisis levels. However, an important fact is that China’s export market has become increasingly diversified. If you refer to the chart, even though the U.S. remains the largest market for Chinese overseas sales, its market share has shrunk from a peak of 22% in the late 1990s to 17% today. In fact, Chinese sales in some of the nontraditional export markets such as Australia, Latin America, Africa and the Middle East have experienced much faster growth in recent years than sales to other developed markets.

Meanwhile, China continues to reduce trade barriers with emerging Asian countries. At the beginning of this year, China and the 10-country Association of South-East Asian Nations (ASEAN) formally established one of the largest regional free-trade zones in the world.

Over the years, the Chinese authorities have worked to boost domestic consumption in an attempt to reduce the economy’s dependence on exports and capital spending. In this sense, slowing capex and exports should be taken as a positive sign, as it means that policy makers’ consumption-boosting initiatives have finally begun to bear fruit.

The Chinese authorities still have a lot of room to boost growth. Infrastructure in the country’s rural regions is still grossly insufficient and needs tremendous government input. Massive domestic savings and the very low public sector debt burden means there is a lot of financial resources the government can utilize to buy a lot of growth, similar to what they have done over the past year. This kind of growth-boosting campaign is of course unsustainable over a prolonged period of time, but China is among the few countries in the world that are most capable of dealing with a crisis scenario with extraordinary policies – and have a significant war chest to do it with.

Hence we should not see a crash or a major crisis of any sorts in 2010. Yes, the markets will have to experience some bumps here and there, in particular when Beijing tries to tighten the screws on lending and rein in liquidity a bit every now and then - but its for the betterment of the economy, not a noose around the economy's neck.

Currently, the authorities are beginning to tighten policies again. The risk factor is the country’s bubble-prone asset markets and potential damage to its banking system. Specifically, as a result of China’s massive household sector savings and highly pro-cyclical global capital inflows, Chinese asset prices are prone to boom-bust cycles. So far the extreme volatility in asset prices, such as the 70% crash in the domestic A-share market and housing price declines in some major metropolitan areas between 2007 and 2008, has inflicted little damage on banks’ overall asset quality, as the above chart would indicate clearly. This is because policymakers have maintained a significant buffer between asset markets and the banking system - banks’ mortgage lending practices have been very conservative, with a mandatory down payment ratio of 20-40% for real estate purchases. Banks’ direct exposure to the stock market is also negligible, as leveraged investments are not allowed.

Recently, the authorities announced that index futures, margin trading and short-selling in the A-share market have been officially approved. Even though it may take months for these instruments to be developed and deployed, and they are undoubtedly positive in terms of improving the efficiency of the domestic capital market.

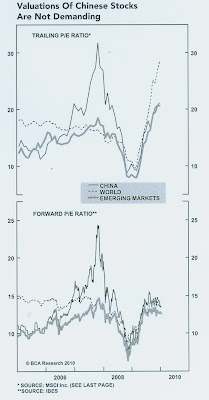

Structurally, China’s economic performance will most likely continue to outpace that of the rest of the world. This warrants a more positive stance on Chinese assets over global benchmarks, especially as current valuations of Chinese assets are comparable to global and emerging market averages. Have a look at the chart above on China's valuations - its very reasonable still. From a cyclical point of view, it’s important to recognize that there is a disconnect between a country’s economic performance and its stock market. One does not need to be super-bullish on an economy’s immediate growth outlook to be positive on its financial asset prices.

Stock markets are highly sensitive to policy shifts, which is a lagging response to economic performance. Weak growth leads to policy easing, which is stimulative for the stock market. Similarly, strong growth normally leads to tightening policy, which bodes ill for equity prices. In some cases, good economic news turns out to be a headwind for stocks. Currently, China’s strong growth recovery is pushing policymakers to tighten, a critical juncture that is typically associated with heightened volatility in equity prices. While the Chinese A-share market will continue to struggle in the coming months, investors should not take this as a sign of pending economic troubles. These tightening measures are good problems to have.

p/s photos: Gu Chen